Extra proof that it’s very onerous to beat the market over time, 95% of finance professionals can’t do it. Mark J. Perry writes on American Enterprise Institute: “The proportion of lively managers who do beat the market is normally fairly small – fewer than 8% in a lot of the circumstances above over the past 15 years; and so they could not maintain that efficiency sooner or later. For a lot of traders, the power to put money into low-cost, passive, unmanaged index funds and outperform 92% of high-fee, extremely paid, skilled lively fund managers looks like a no brainer, particularly contemplating it requires no analysis or time looking for the lively managers who beat the market up to now and would possibly accomplish that sooner or later.”

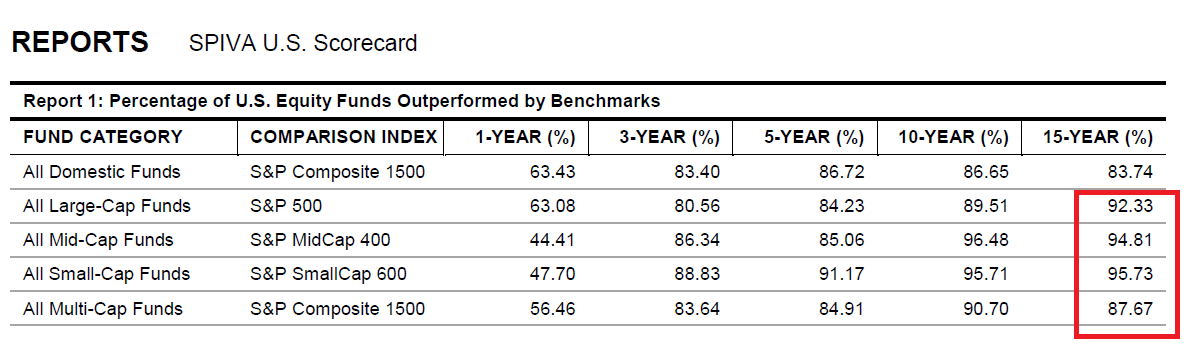

S&P Dow Jones Indices, the ‘de facto scorekeeper of the lively versus passive investing debate,’ lately launched its SPIVA U.S. Yr-Finish 2017 report. Right here’s an summary of the SPIVA Scorecard:

There may be nothing novel in regards to the index versus lively debate. It has been a contentious topic for many years, and there are few robust believers on each side, with the overwhelming majority of market members falling someplace in between. Since its first publication 16 years in the past, the SPIVA Scorecard has served because the de facto scorekeeper of the lively versus passive debate. For greater than a decade, we have now heard passionate arguments from believers in each camps when headline numbers have deviated from their beliefs.

Through the one-year interval, the share of managers outperforming their respective benchmarks noticeably elevated in classes like Mid-Cap Progress and Small-Cap Progress Funds, in comparison with outcomes from six months prior. Over the one-year interval, 63.08% of large-cap managers, 44.41% of mid-cap managers, and 47.70% of small-cap managers underperformed the S&P 500, the S&P MidCap 400, and the S&P SmallCap 600, respectively.

Whereas outcomes over the quick time period had been favorable, the vast majority of lively fairness funds underperformed over the longer-term funding horizons. Over the five-year interval, 84.23% of large-cap managers, 85.06% of mid-cap managers, and 91.17% of small-cap managers lagged their respective benchmarks.

Equally, over the 15-year funding horizon, 92.33% of large-cap managers, 94.81% of mid-cap managers, and 95.73% of small-cap managers did not outperform on a relative foundation.